The American debt is out of control, but America can afford it

because of the American dollar.

Image: Adobe Stock

Image: Adobe StockThe US debt will reach $30T in the coming months. This is a certainty. While this seemed hardly imaginable only ten years ago when the US debt was still “only” $14.3T in 2011, it is now unavoidable as it reaches $28.8T at the time of writing.

In only ten years, the US debt has thus increased by +101%.

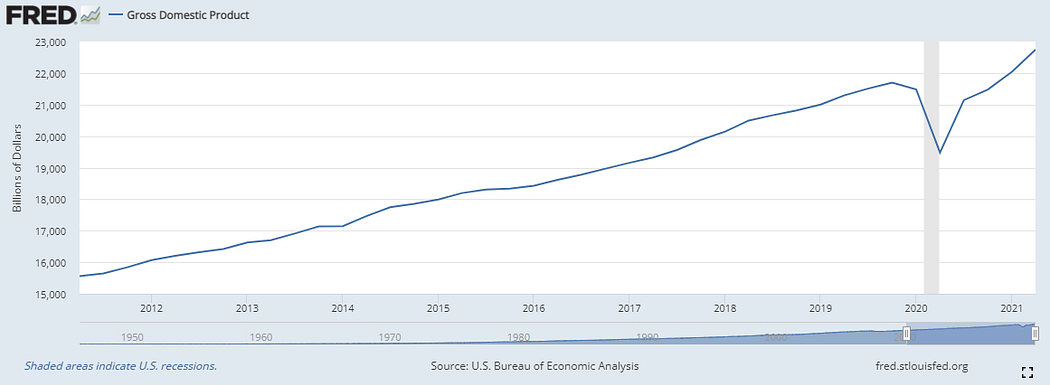

This would not be so serious if America’s GDP had grown at the same rate over this period. However, this is not the case, since the US GDP has stalled. Over the same period the US GDP grew by “only” +46.5%.

America Gross Domestic Product — Source: The Fed

America Gross Domestic Product — Source: The FedUnder these conditions, it is not surprising that America’s debt-to-GDP ratio has risen well above 100% and currently stands at 127%. The time when having a debt-to-GDP ratio above 100% was taboo is over.

Among the world’s major economic powers, it has even become the norm.

The American debt is divided into two main categories

The US debt is managed by the US Treasury Department through the Bureau of Public Debt. The debt is divided into two broad categories: intra-governmental holdings and debt held by the public.

Intra-governmental debt is debt that the U.S. Treasury owes to other federal agencies. Some agencies, like the Social Security Trust Fund, collect more tax revenue than they need. Instead of putting this money under a giant mattress, these agencies invest in U.S. Treasury bonds.

Currently, this intra-governmental debt is about $6.4T. TO KNOW MORE ABOUT OUR DEBT... CLICK HERE...